Retroficiency, provider of the on-demand Building Efficiency Intelligence™ (BEI) platform, today introduced Virtual Energy Assessment™ (VEA) — a sophisticated data analytics solution that can accurately determine actionable energy savings opportunities without stepping on-site or installing specialized hardware. Using only a building's address and its energy consumption interval data, VEA enables utilities, energy service providers and others to rapidly prioritize a portfolio of commercial buildings and cost-effectively identify potential energy efficiency improvements related to heating, cooli ng, lighting, building controls and more.

ng, lighting, building controls and more.

Virtual Energy Assessment will be used primarily by utilities and their program managers to systematically target candidates for energy efficiency programs and motivate them to reduce consumption, and by energy service providers to identify savings opportunities for their clients on a large scale. The company is currently piloting Virtual Energy Assessment with multiple large utilities, including Iberdrola USA, which serves nearly 2.5 million customers in New York and Maine; and energy service providers, including Schneider Electric, a global specialist in energy management.

"We are very excited about the initial results of our work with major customers, where VEA's estimated energy savings and efficiency recommendations were validated against traditional building energy audits," said Bennett Fisher, CEO and co-founder, Retroficiency. "The significant interest from major customers in Virtual Energy Assessment furthers our belief that the untargeted, manual-driven approach to identifying opportunities and energy efficiency measures could be made much more effective using solutions such as ours."

The Virtual Energy Assessment - How it Works

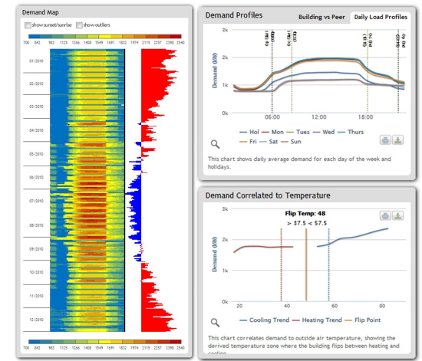

Virtual Energy Assessment delivers actionable operational and retrofit recommendations by leveraging an extensive database of commercial building models and advanced data analytics. Using a proprietary matching engine, VEA forms a unique weather-normalized reference model for each building and compares it to the building's actual performance to determine overall dollar and energy savings estimates.

Virtual Energy Assessment then disaggregates building end use loads — such as heating, cooling and lighting — to determine which systems are driving inefficiency. VEA also identifies suboptimal usage patterns to provide specific building efficiency intelligence insights, including excessive unoccupied energy use, simultaneous heating and cooling, chiller inefficiencies, and more.

The result is a distillation of tens of thousands of data points into deep and accurate insights for benchmarking and potential energy savings opportunities. These easy-to-understand Energy Conservation Indicators™ (ECIs) are anchored in no- and low-cost recommendations designed to achieve immediate energy savings in individual buildings and across larger commercial building portfolios.

Retroficiency's Building Efficiency Intelligence Platform™

Retroficiency's Building Efficiency Intelligence (BEI) platform leverages sophisticated data analytics to deliver highly accurate, actionable insights at each step of the process — from initially isolating over-consuming buildings and specific energy sources within, to qualifying retrofit projects and tracking post-implementation performance. BEI now pairs Virtual Energy Assessment with the Automated Energy Audit™ solution, which streamlines the traditional energy auditing process. Automated Energy Audit takes building asset data to make accurate inferences about a building's energy systems to deliver detailed retrofit recommendations, reducing audit time and expense by up to 80 percent.

Retroficiency's platform includes an online dashboard as well as customizable reporting capabilities to help customers deliver recommendations to key stakeholders in the form they desire.

The introduction of Retroficiency's Virtual Energy Assessment builds on the company's acquisition of VEA's core underlying software IP as part of its $3.32 million initial round of financing announced in November 2011.